Attending a Philanthropy & Philanthropic Estate Planning Seminar provides crucial benefits by showing you how to secure your family's financial future while maximizing your charitable impact. You will learn tax-smart strategies, such as utilizing charitable gifts of appreciated assets (like stocks or RRIFs), to generate significant tax credits that can reduce or eliminate the tax burden on your estate. This strategic planning clarifies your legal intentions, minimizes probate costs, and ultimately ensures your wealth is transferred efficiently, preserving more for your heirs and leaving a powerful, lasting legacy that reflects your deepest values.

If you would like to book Mark Albert, CEA, EPC as a Speaker, or to do an Estate Planning Seminar that incorporates depth of information on various effective strategies to donate to a registered charity, please contact Mark at either 416-659-6655 or markalbertpfs@gmail.com.

Depth of Expertise: Why the CEA and EPC Designations Matter

When discussing the sensitive topics of aging, death, and charitable giving, the "who" behind the information matters. Mark’s approach is uniquely informed by his dual specialized designations, which allow him to see the full picture of a client’s life.

1. Certified Executor Advisor (CEA)

As a Certified Executor Advisor, Mark understands the immense burden placed on executors. In his seminars and workshops, he provides a "view from the finish line."

-

The Benefit to You:

-

Mark doesn’t just help you plan; he helps you ensure your plan is executable. By understanding the practical hurdles executors face, he can show you how to structure your philanthropy and estate distribution to avoid family conflict and administrative nightmares.

-

2. Elder Planning Counselor (EPC)

The Elder Planning Counselor designation signifies a deep understanding of the "Total Life Needs" of those 55+. This isn't just about money; it’s about the physical, emotional, and social transitions of aging.

-

The Benefit to You:

-

Mark approaches legacy planning with a "human-first" lens. He understands the nuances of aging from health considerations to the desire for community impact. This allows him to facilitate workshops that are empathetic, relatable, and tailored to the specific life stages of his audience.

-

Planning for the future is more than a legal obligation; it is an opportunity to make a final statement of your values. Whether you are a non-profit looking to educate donors or a community group seeking clarity on the estate process, Mark’s workshops provide the roadmap.

Why Your Legacy Deserves a Plan

In the journey of building wealth, we often focus intensely on accumulating assets, but far less on the strategic, thoughtful process of transferring them. For many Canadians, this leads to an unintended consequence: a substantial portion of their lifetime effort is often absorbed by taxes, fees, and delays that could have been avoided.

This is precisely why we host the Philanthropy & Philanthropic Estate Planning Seminars. This is not just a discussion about writing a Will; it is a vital planning session designed to help you transform your generosity into a powerful, tax-efficient legacy that serves both your family and the causes you care about most.

The most compelling reason to attend is simple: peace of mind and financial efficiency. You will discover strategies to significantly reduce the tax burden on your estate, allowing you to pass on more wealth to your heirs and less to the government.

We move beyond simple documents to a holistic plan that not only protects your loved ones but also empowers your deepest values, ensuring your legacy is defined by your impact, not by avoidable costs.

What You Will Gain: A Strategic Look at Your Future

Our comprehensive seminar cuts through the complexity of Canadian estate law and charitable giving. You will learn the foundational elements of a strong estate plan, including the crucial role of Wills and Powers of Attorney, and how to structure your assets to minimize crippling probate fees.

Most importantly, we will reveal the optimal assets for strategic giving, such as appreciated publicly traded securities or RRIFs. You will learn how these assets, when gifted to a qualified Canadian charity, can generate significant tax credits that directly offset capital gains and other taxes at death, turning a tax liability into a charitable gift.

By the end of this session, you will possess the knowledge to confidently implement strategies that protect your family and create a meaningful, lasting charitable footprint.

The Desire to Attend: Turn Your Values Into Your Legacy

Ask yourself: Are you confident your current estate plan reflects your true values and uses your wealth as efficiently as possible? If you are planning for or currently in retirement, own a business, or have significant assets, this seminar is a crucial investment in your future. Leaving a legacy is not just for the ultra-wealthy; it is for everyone who has built something meaningful in their lifetime.

Benefits for attending a Philanthropy & Philanthropic Estate Planning Seminar:

Tax & Financial Benefits

-

Estate Tax Minimization:

-

Learn how to use charitable giving to strategically generate donation tax credits that can offset up to 100% of the net income in the year of death and the year preceding death. This can significantly reduce or even eliminate the final tax bill on your estate.

-

-

Optimal Asset Selection:

-

Discover which assets are the most tax-efficient to donate. Specifically, understand the "double tax benefit" of donating publicly traded securities (stocks, mutual funds). When you donate these directly, you avoid the capital gains tax on the appreciation and your estate receives a charitable tax receipt for the full fair market value.

-

-

Registered Asset Tax Relief:

-

Learn how to name a charity as the beneficiary of high-tax assets like RRSPs or RRIFs. This moves the tax liability from your estate (which would otherwise pay full income tax on the funds) to the charity, which is tax-exempt, thus generating a massive tax credit for your estate.

-

-

Probate Cost Reduction:

-

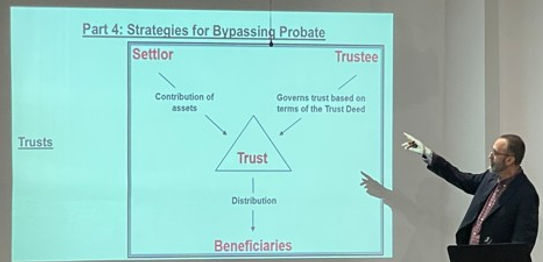

Structuring your assets strategically through trusts, designations, and gifts of life insurance can help assets bypass the Will, potentially reducing provincial probate fees (Estate Administration Tax).

-

-

Increased Wealth for Heirs:

-

By intelligently reducing the taxes and fees on the estate, you preserve a greater amount of your remaining wealth for your family beneficiaries.

-

Legal & Planning Clarity

-

Demystifying Estate Documents:

-

Gain a clear understanding of the essential Canadian documents: the Will, Powers of Attorney, and how Graduated Rate Estates (GREs) function for maximum flexibility in tax planning within the first 36 months after death.

-

-

Understanding Giving Vehicles:

-

Receive an overview of advanced philanthropic tools and when to use them, including:

-

Donor-Advised Funds (DAFs) (immediate tax receipt, grants over time)

-

Gifts of Life Insurance (leveraging small premiums into a large future legacy)

-

Charitable Remainder Trusts (CRTs) (receiving income now, with the remainder going to charity later).

-

-

Avoiding Common Errors:

-

Learn about common pitfalls, such as improperly worded bequests or mismanaging the valuation of gifted property, which can void your charitable intentions or tax benefits.

-

Personal & Legacy Benefits

-

Leaving an Intentional Legacy:

-

Move beyond simply passing on assets to creating a legacy that reflects your core values and life story. You ensure the causes you care about (e.g., healthcare, arts, education) continue to thrive.

-

-

Family Communication:

-

Gain the confidence and language to open positive discussions with your family about your philanthropic goals, which can reduce conflict and build shared family purpose.

-

-

Peace of Mind:

-

Knowing that your estate is structured to be both legally sound and financially efficient provides profound peace of mind, securing your family's future while maximizing your community impact.

-

-

Non-Solicitation Environment:

-

Seminars provide a low-key, non-threatening educational environment where you can learn, ask questions, and gather comprehensive information from experts without feeling pressured to make an immediate decision or donation.

-

If you would like to book Mark Albert, CEA, EPC as a Speaker, or to do a Philanthropy & Philanthropic Estate Planning Seminar, please contact Mark at either 416-659-6655 or markalbertpfs@gmail.com.

Philanthropy & Philanthropic Estate Planning Seminars are available in the following cities:

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Fort Erie

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Niagara Falls

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Port Colborne

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Wainfleet

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Grimsby

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Niagara-on-the-Lake

Philanthropy & Philanthropic Estate Planning Seminars Speaker in St. Catharines

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Welland

Philanthropy & Philanthropic Estate Planning Seminars Speaker in West Lincoln

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Pelham

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Thorold

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Hamilton

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Waterdown

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Burlington

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Oakville

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Brampton

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Mississauga

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Toronto

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Greater Toronto Area

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Barrie

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Alliston

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Innisfil

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Niagara Region

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Halton Region

Philanthropy & Philanthropic Estate Planning Seminars Speaker in Peel Region

For educational videos, please subscribe to MONEY with MARK ALBERT™

The Key Benefits of Our Seminars for Seniors and Retirees

1. Lower Your Taxes and Keep More Wealth in Your Family

One of the biggest reasons seniors attend our seminars is to learn how to significantly lower the tax bill on their estate. This is often called Tax-Efficient Giving. We show you how to use charitable donations as a tool for tax reduction estate planning. For instance, if you own stocks or mutual funds that have grown a lot in value, you usually have to pay capital gains tax when you sell them. However, by donating those appreciated stocks directly to charity, you pay zero capital gains tax, and your estate still gets a large tax receipt. We also cover how to manage your registered retirement accounts, like RRSPs and RRIFs. These accounts are heavily taxed when you pass away, but by making a charitable donation through them, the donation receipt can completely cancel out the tax owed, turning a huge tax burden into a meaningful gift.

2. Build a Lasting Legacy That Reflects Your Values

These seminars are not just about paperwork; they are about Legacy Planning, deciding what you want to be remembered for. We help you answer the big question: "How to leave a legacy in your Will?" We guide you in connecting your personal values and life experiences (your "Philanthropic Desire") to a concrete plan. This ensures that the assets you transfer truly support the causes and people you care about most. Furthermore, having a clear, values-based plan is the best way to maintain Family Harmony. When you communicate your intentions clearly, you reduce the chances of confusion or conflict among your heirs, giving you peace of mind that your wishes will be respected.

3. Learn Smart Ways to Give with Structured Planning

Our seminars teach you the specific, proven methods of giving used by professional Planned Giving Advisors. You'll learn about setting up a Donor Advised Fund (DAF), which is one of the most popular and flexible charitable giving strategies. A DAF allows you to get your tax deduction right away, but you can take your time deciding which charities receive the money over many years. This is a huge advantage of a Donor Advised Fund because it lets your family stay involved in giving long after you're gone. We also cover simpler Charitable Bequests (leaving a gift directly in your Will) and even using life insurance to create a large donation at death without using up your current assets.

4. Get Expert Clarity from a Trusted Advisor

The complex world of estates and philanthropy can feel overwhelming. By attending a seminar led by an expert like Mark Albert, CEA, EPC, you receive clear, easy-to-digest guidance. You get the confidence that your plan for integrating philanthropy into your estate plan is legally sound and financially efficient. This structured learning environment helps you overcome the emotional reasons people often delay planning, allowing you to move forward with a clear head and ensure your wealth transfer is handled professionally.